Will the Consumer Financial Protection Bureau protect the public from high-fee “release cards”?

Consumer Financial Protection Bureau seeks comments on whether formerly incarcerated people should be forced to pay high fees on "release cards".

by Stephen Raher, February 6, 2015

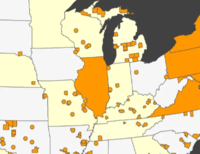

Many prisons and jails, citing budget pressure, are on a constant search for functions that can be outsourced. Facilities hire companies to cook food, provide medical service, and teach classes. One insidious wave of outsourcing that has been growing in popularity is using a contractor to pay incarcerated people money to which they are lawfully entitled. But the prison or jail doesn’t pay for this service—instead, the contractor makes money through imposing exploitative fees on people who have just been released.

When a person leaves jail or prison, they may be entitled to money for a variety of reasons (for example: money in their possession when initially arrested, money earned working in the facility, or money sent by friends and relatives). Facilities used to issue checks or give refunds in cash. But an increasing number of jurisdictions are now giving people their money in the form of pre-paid debit cards (often called “release cards”). These cards are often difficult to use and carry extremely high fees.

In 1968, when new electronic payment systems were in their infancy, Congress passed the Electronic Fund Transfer Act, which was designed to protect consumers who pay or receive money through electronic channels. The Act is implemented by detailed regulations that are currently overseen by the Consumer Financial Protection Bureau (CFPB). Over time the regulations have grown to encompass debit cards, and special protections have been added concerning prepaid debit cards. But because of the way that jails and prisons structure release cards, many of the most important protections do not apply.

In response to general complaints about abusive debit-card practices, the CFPB has announced that it will revise the current rules and has invited public comment. Although the CFPB has not specifically mentioned release cards, the problems arising from prison and jail outsourcing are precisely the type of abuses that the CFPB must hear about.

PPI will be submitting comments to the CFPB, but you can help too. Any individuals or organizations with examples of abusive release-card practices or opinions about whether release cards should be regulated by the CFPB should submit comments before the deadline of March 23, 2015. Anyone can submit comments through the docket on regulations.gov.

(For alternative submission methods, see the original notice in the Federal Register.)

[…] the scope of its regulation to reign in the exorbitant costs of calling home from prison and jail, we’re tackling another fee-driven industry preying on people who can least afford […]