Consumer Financial Protection Bureau should regulate release cards

PPI submits comment to the Consumer Financial Protection Bureau urging regulation of high-fee release cards.

by Aleks Kajstura, March 18, 2015

While the FCC is still considering the scope of its regulation to reign in the exorbitant costs of calling home from prison and jail, we’re tackling another fee-driven industry preying on people who can least afford it.

The Consumer Financial Protection Bureau is now proposing tighter regulations of high-fee prepaid debit cards, and we’re lucky to have the help of volunteer attorney, Stephen Raher, to submit a comment from the Prison Policy Initiative urging the CFPB to extend its regulations to explicitly cover release cards.

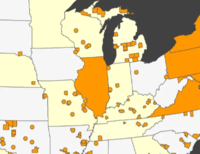

The CFPB needs to act quickly because correctional facilities are increasingly using these expensive cards to repay people they release — money in someone’s possession when initially arrested, money earned working in the facility, or money sent by friends and relatives.

Before the rise of jail release cards, people were given cash or a check. Now, they are instead given a mandatory prepaid Mastercard, which comes with high fees that eat into their balance. These cards charge for basic things like:

- Having an account (up to $3.50/week)

- Making a purchase (up to $0.95)

- Checking your balance (up to $3.95)

- Closing the account (up to $30.00)

To put this into perspective, if someone is released with $125, a $2-per-week maintenance fee is equivalent to a finance charge of 77% per year. If that same hypothetical cardholder makes ten purchases of $12 each, then a $0.50 per-transaction-fee would amount to $5, or 4% of the entire card balance (on top of maintenance fees). If the cardholder wishes to convert a prepaid card into cash, he or she must pay $10 to $30 (8% to 24% of the entire deposit amount) merely to close the account.

Stay tuned here for updates on the CFPB regulations, and in the meantime, check out our comment.

And thanks again to Stephen for drafting the comment! (You may remember Stephen from his work in rebutting local government officials who insisted that jail phone kickbacks were necessary.) If you’d like to join our growing group of skilled volunteers, check out our Young Professionals Network.

[…] the Consumer Financial Protection Bureau issued a final rule on prepaid debit cards. Last year, the Prison Policy Initiative and other groups urged the CFBP to use this rulemaking to address abusive practices related to prepaid debit cards issued to people […]