The multi-million dollar market of sending money to an incarcerated loved one

Private companies amassing monopoly contracts, creating potential to rake in $172 million from friends and family sending money to incarcerated loved ones.

by Stephen Raher, January 18, 2017

As with many areas of government, prisons and jails are increasingly shifting costs to those who can least afford it: incarcerated people and their families. In correctional facilities, this often takes the form of copays for medical care, forcing incarcerated people to purchase clothing or hygiene items, and cutting food service in favor of for-profit “canteens.” Because most incarcerated people lack money to cover such expenses, this means that family members must frequently transfer money to “inmate trust accounts.”

Historically, families could send money to an incarcerated relative’s account by simply mailing a money order. But private companies saw an opportunity to use these accounts as a potential source of profits. For an upcoming report, we set out to find the answer to a seemingly straightforward question: How much do these companies earn off of money transfers? It’s hard to say, because there is no publicly-available data that gives a complete picture; however, certain limited data can be used to arrive at a rough estimate.

Four states have published data on the volume of money transfers in their state prison systems. This data covers Nevada, Ohio, and Wyoming (all calendar year 2011), and Pennsylvania (2014). Dividing the total amount of transferred funds by the states’ respective prison populations yields average annual transfers of $737 per incarcerated person. Multiplying this average amount by the total population of all state prisons (in 2016) would yield annual transfers of $995 million.

But the amount of money transferred doesn’t tell us how much money the companies make on the process. The difficulty in estimating fee revenue comes from the fact that the amount of the transaction fee varies among jurisdictions. In addition, some jurisdictions may still allow family members to send funds for no fee through the mail; while other states may charge a fee for payments by mail, or simply prohibit no-fee options.

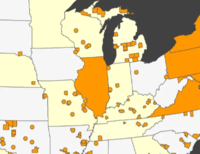

Direct evidence of fee revenue is available for JPay, Inc., one of the largest payment processors for prisons and jails. JPay is currently a subsidiary of telecommunications firm Securus Technologies, which is owned by private equity firm Abry Partners. In an April 2015 presentation to potential lenders, Securus stated that in 2014, JPay made $53 million in fees (page 49) on transfers of $525 million (page 38). This suggests an average fee of 10% (i.e., $53 million ÷ $525 million = .10).

If, as stated above, the total amount of state-prison money transfers is $995 million per year, then with fees at 10%, payment processors could potentially make up to $99 million in fees, assuming every prison system in the country privatized money transfer services and eliminated no-fee options. This aligns precisely with the Securus/JPay investor presentation, which estimates the total market for money transfers in state prisons to be worth $99.2 million in corporate revenue (page 45).

My discussion so far has not mentioned county jails and the federal prison system, because information about money transfers in these settings is even more difficult to find. In fact, some of the only information available at this time is Securus’s estimate of the total potential market. In 2015, Securus told potential investors that the total potential fee revenue from county jails and federal prisons was $58 million and $15 million respectively.

Notably, the most lucrative money transfer market may not even involve correctional facilities. Among the proliferation of user fees being imposed on the poor are fees levied on people serving time on probation or parole. Processing those payments means lots of money for companies like Securus/JPay. In fact, Securus believes that it if it obtained contracts for every state, federal, and local prison/jail in the country, it would be able to earn up to $172 million in fees. In contrast, the company believes that the total market for probation- and parole-related payments is worth nearly $300 million in fees.

Governments process hundreds of millions of dollars of payments every day. In the context of tax payments, court filings, license applications, and other types of user fees, agencies have created innovative no-cost options (including electronic payments) that facilitate quick, efficient transfers. But in the correctional setting, administrators have largely ignored these innovations, instead opting to outsource this function to private companies seeking to profit. As a result, money transfers are yet another way in which private companies profit off of families and friends seeking to support their incarcerated loved ones.